Enabling intermediary-led business models by leveraging middlemen and AI to provide a high-touch, human interface to consumers.

Early believers of pioneer founders

In India's low-trust, high-touch economy, consumers prefer trusted human intermediaries over faceless online brands. We invest in companies that supercharge these on-the-ground partners with AI - handling systematic coordination while preserving the human relationships that drive trust and conversion.

Talked about, most recently

Serve unbranded products nobody else wants? Check. Incentivise housewives to become your salesforce instead of owning your own customers? Check. Embrace ₹200 average order values that would bankrupt competitors? Check. Each decision conventional wisdom said would fail became a defensible moat.

The driver navigating through WhatsApp DPs, the cook coordinating meal plans, the hotel owner managing operations - they don't need to learn new interfaces. They need technology that speaks their language, literally and culturally.

Today, we're pulling back the curtain to show you exactly how we communicate and build on ideas at Good Capital.

Today, we're pulling back the curtain to show you exactly how we communicate and build on ideas at Good Capital.

Unlike previous waves of automation that required businesses to adapt to technology, Integrated AI adapts to how professionals already work.

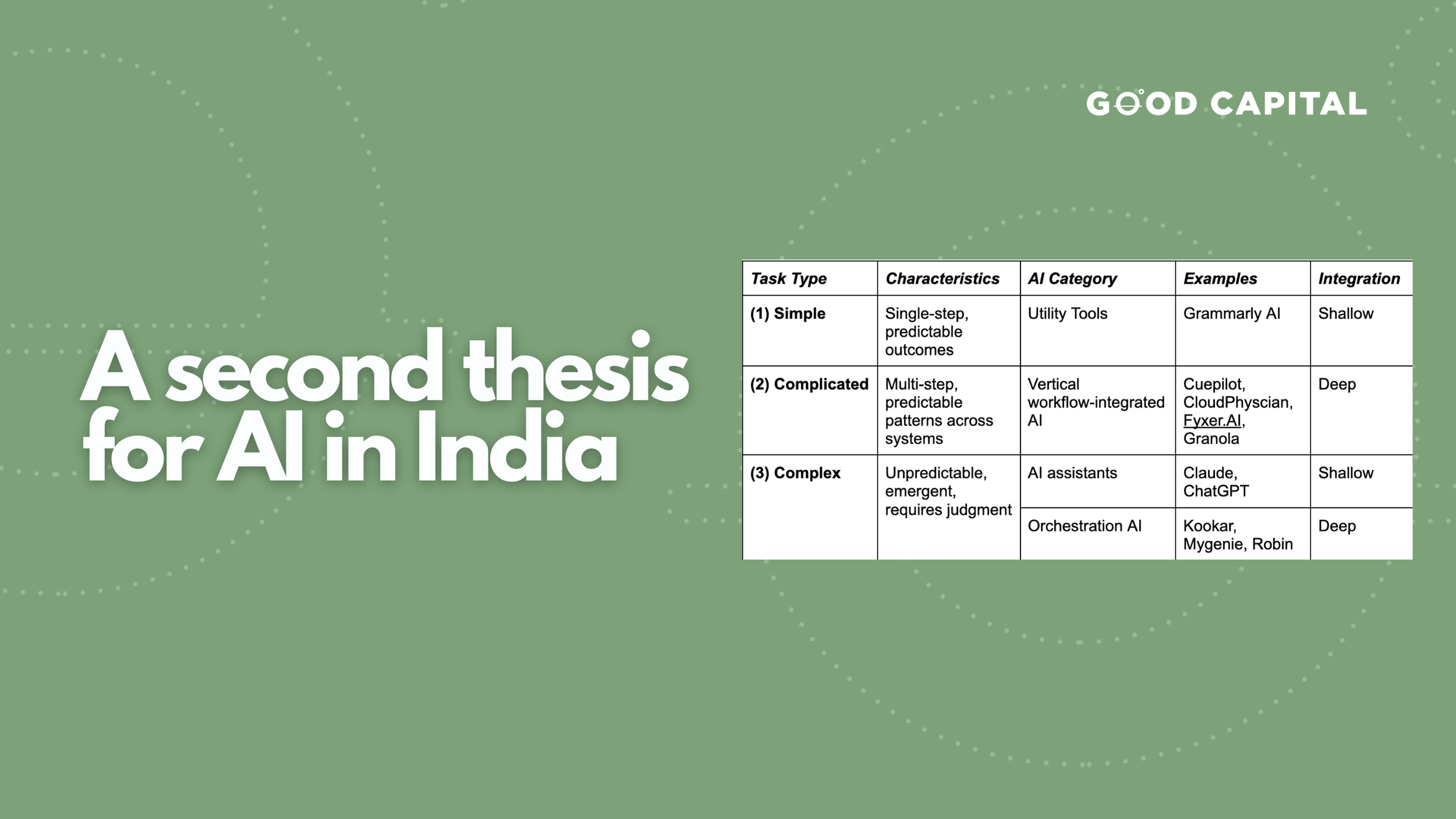

Productivity challenges can't be solved by tools alone - we need systematic thinking & coordination, which we're now starting to see via Orchestration AI. And nowhere is this more evident than in India's pervasive workflow vacuum.

India's most powerful conglomerates - Reliance, Tata, Aditya Birla - have everything you'd expect to win in e-commerce. Yet in online retail, these giants are consistently getting outmaneuvered by digital-first players..

We have the hands to build and the vision to dream, but we're missing the crucial middle that connects the two. While tech has digitised our businesses, it hasn't solved the core problem: software can track what happened yesterday, but can't design what should happen tomorrow.

When done right, internal rounds are one of the best ways to buy time, protect valuation, and keep building - without the fundraising circus (let's call it what it is).

Why is the world's most advanced AI company, which has achieved unprecedented success with software, suddenly interested in building physical devices?

AI is creating an inflection point in India’s long-tail economy and enhancing the models that thrive in this fragmented setting, not by replacing human networks, but by giving them superpowers they never had before.

While Western retail consolidates around platform giants, India's $800 billion retail market remains beautifully fragmented - 90% unbranded products, relationship-driven, and distributed across millions of micro-retailers who form one of the world's largest consumer markets.

Every few years, the startup world discovers a new generation and loses its mind. Right now, Gen Z is the target, and brands are acting like this generation has landed from Mars.

In a world obsessed with consolidation and scale, India's manufacturing landscape tells a different story: one of specialisation, fragmentation, and resilience.

What starts as a delightful connection inevitably morphs into commercial saturation. This pattern has played out so consistently in social apps that we’ve come to call it the "Feature-Monetisation-Engagement Curve".

-

Why did we Invest in Meesho?

Part of our Vintage fund, Meesho was one of our first investments. Our conviction in the founders is what made us invest in what became a category-creating Unicorn.

-

Why did we invest in Skillbee?

Skillbee has been able to close a major gap in the global labour market and we are proud to partner with them as they increase access to jobs for aspirational Indians around the world.

-

How Wealthy is democratising wealth management

Wealthy is serving a whole new target audience in India — the affluent mass with curated financial products that have been previously reserved for HNIs

![A thesis for AI in India: Solving the drudgery tech left behind [Part 2]](https://images.squarespace-cdn.com/content/v1/64e7035b6c1be702f6e4f0db/1754632388344-5IN9AKOUM63SHSGG9K5A/Copy+of+Views+Covers+%282%29.png)

![A thesis for AI in India: Solving the drudgery tech left behind [Part 1]](https://images.squarespace-cdn.com/content/v1/64e7035b6c1be702f6e4f0db/1753432740946-XSCVKG9RZAUFCC9VG8NK/Copy+of+Views+Covers+%281%29.png)