India's Chip in the AI Game

In a world increasingly driven by artificial intelligence, the humble semiconductor has become the unsung hero of technological progress. As India positions itself to be a major player in the global AI landscape, the country is making bold moves to secure its place in the semiconductor value chain. The recent India Semiconductor Conference, inaugurated by Prime Minister Narendra Modi, underscores the government's commitment to this vision, announcing policy changes that could reshape India's technological future.

From Bytes to Brilliance

India's semiconductor journey is not just about reducing import dependence; it's about fueling the nation's AI ambitions. With projections suggesting India's semiconductor consumption will skyrocket to $110 billion by 2030 from $24 billion in 2021, the stakes couldn't be higher. This surge in demand isn't just numbers on a spreadsheet—it's the beating heart of India's digital transformation.

Consider this: smartphone penetration in India is set to leap from 42% in 2020 to a staggering 96% by 2040. The imminent 5G rollout promises to unleash a tsunami of IoT applications, while data centers are poised to double their capacity by 2023. Even our cars are getting smarter, with automotive electronics penetration expected to hit 45% by 2030.

But here's the kicker: India currently imports 100% of its chips. In the high-stakes game of AI, this reliance on imports isn't just an economic vulnerability—it's a strategic Achilles' heel.

Enter the government's $10 billion Production Linked Incentive (PLI) scheme. This isn't just another policy—it's India's bold bet on its technological future. With fiscal support ranging from 30% to 50% on project costs for various types of semiconductor manufacturing, India is rolling out the red carpet for global chipmakers.

The early movers are already making waves. Vedanta-Foxconn is eyeing India's first 28nm digital fab, while IGSS Ventures is planning a 65nm analog fab. Even tech giants like Reliance and Tata are exploring opportunities in this space. These aren't just business decisions; they're the first notes in India's silicon symphony.

But let's not get ahead of ourselves. Building a semiconductor industry from scratch is like trying to construct a skyscraper with toothpicks—it's incredibly complex and fraught with challenges.

The Road Less Fabricated

For starters, setting up a single foundry costs a cool $10-15 billion. That's not pocket change, even for India's biggest conglomerates. Then there's the ecosystem challenge. Semiconductor manufacturing isn't just about fancy machines—it's a complex dance of over 300 inputs, from specialized gases to ultra-pure chemicals. India's current ecosystem is like a jigsaw puzzle with most pieces missing.

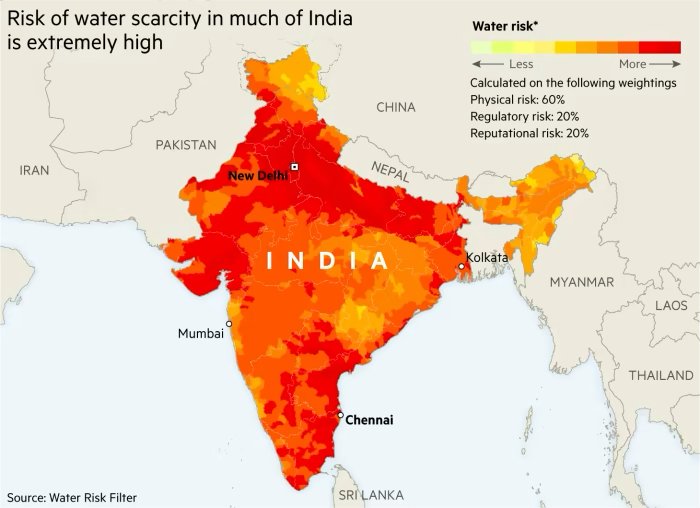

Talent is another hurdle. While India churns out engineers by the thousands, chip manufacturing requires niche skills that are currently as rare as hen's teeth in the country. And let's not forget the basics—power and water. Fabs are notorious power guzzlers and water hogs, two resources that India struggles with even on a good day.

But here's where it gets interesting. India isn't trying to build Rome in a day. The approach is pragmatic and phased. By prioritizing analog fabs and assembly, testing, marking, and packaging (ATMP) units with lower barriers to entry, India is taking baby steps towards semiconductor self-reliance.

Initiatives like the Chips-to-Startup program are laying the groundwork for future talent, while state-level clusters are being developed to streamline raw material sourcing. India is also leveraging its diplomatic muscle, exploring partnerships through forums like QUAD and bilateral relationships with Taiwan and Israel.

For the savvy investor, India's semiconductor push isn't just about manufacturing—it's opening up a treasure trove of opportunities across the value chain. From chip design startups like Saankhya Labs to companies developing electronic design automation (EDA) tools, the possibilities are as varied as they are exciting.

Take AlphaICs, for instance. This Bangalore-based startup is making waves with its AI-optimized processors, tailored for edge computing applications. Or consider SIGNALCHIP, which is developing indigenous 5G chips. These aren't just companies; they're the vanguard of India's technological revolution.

But why should AI enthusiasts (read: Good Capital) care about semiconductors? The answer is simple: AI is only as good as the hardware it runs on. As AI models grow more complex and data-hungry, the need for specialized, high-performance chips becomes paramount. India's push into semiconductors isn't just about making chips—it's about laying the foundation for AI supremacy.

Imagine AI models trained on India-specific data, running on India-made chips, solving uniquely Indian problems. From healthcare diagnostics that understand local contexts to agricultural AI that can handle India's diverse climatic conditions—the possibilities are endless.

India's semiconductor ambitions are audacious, no doubt. The road ahead is long and winding, fraught with technical, financial, and geopolitical challenges. But the potential rewards are immense. By building a robust semiconductor ecosystem, India isn't just aiming for technological self-reliance—it's positioning itself as a key player in the global AI landscape.