The Technology behind Good Capital (Part 2)

This is the first part of a multi-part series that we are sharing with our LPs through our newsletter, India Technology Review (ITR)

In our last issue, we pulled back the curtain on Good Capital's deal evaluation engine - the digital scaffolding that enables us to distill 2,000 potential investments into 6-8 high-conviction bets each year.

Deal evaluation is just the opening act. Today, we're diving into what happens after the term sheet is signed. How do we transform a fresh investment into a thriving partnership? Let's explore the technology powering our portfolio onboarding and management.

Portfolio onboarding

Strong investment returns are rooted in strong founder relationships. We've designed portfolio engagement to make this a two-way partnership rather than a one-way reporting street.

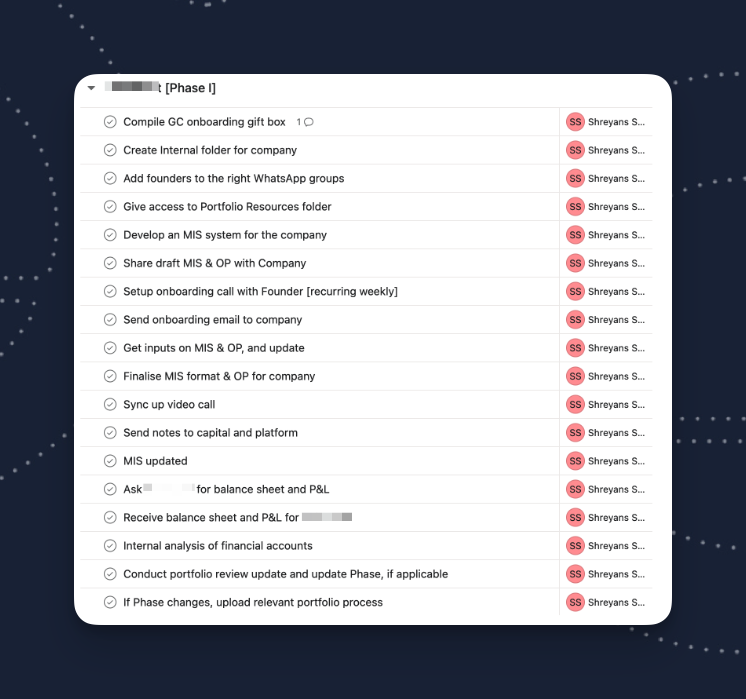

It starts with onboarding. The moment a deal is signed, an Asana workflow kicks in, guiding founders and our team through all the steps needed to get them plugged into the Good Capital platform. From compliance and banking to team intros and reporting rhythms, we ensure a zero-friction experience from day one.

Portfolio Updates

Founders solving big problems often delay smaller tasks like sending in business updates. Even the most diligent founders need a gentle nudge sometimes.

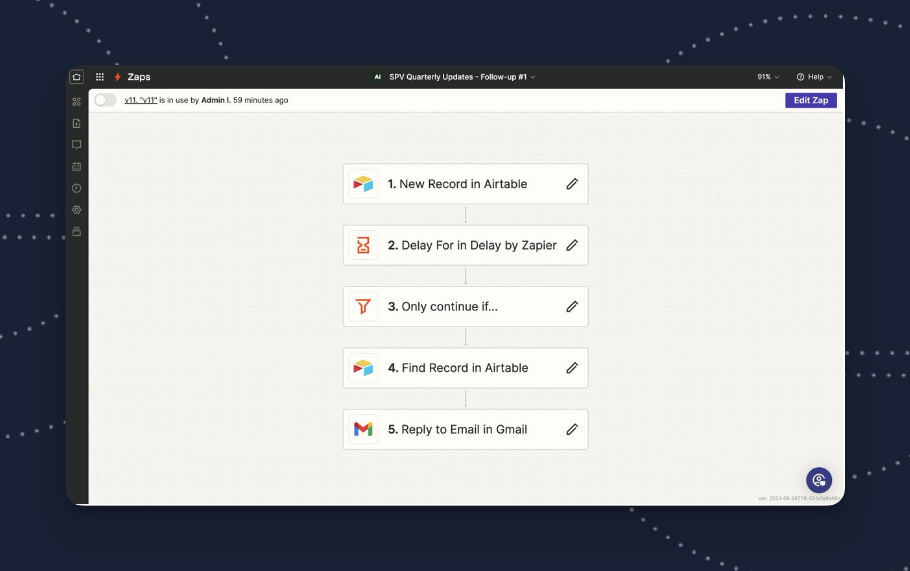

We developed an automated email follow-up system that creates urgency without overwhelming our team with repetitive tasks. Through a trifecta of Airtable fields, Zapier workflows and easy Paperform updates, we have been able to gently nudge our portfolio companies for data submission without involving humans.

Strategically designed Airtable views trigger personalized follow-ups. It's like having a tireless assistant who never forgets to check in.

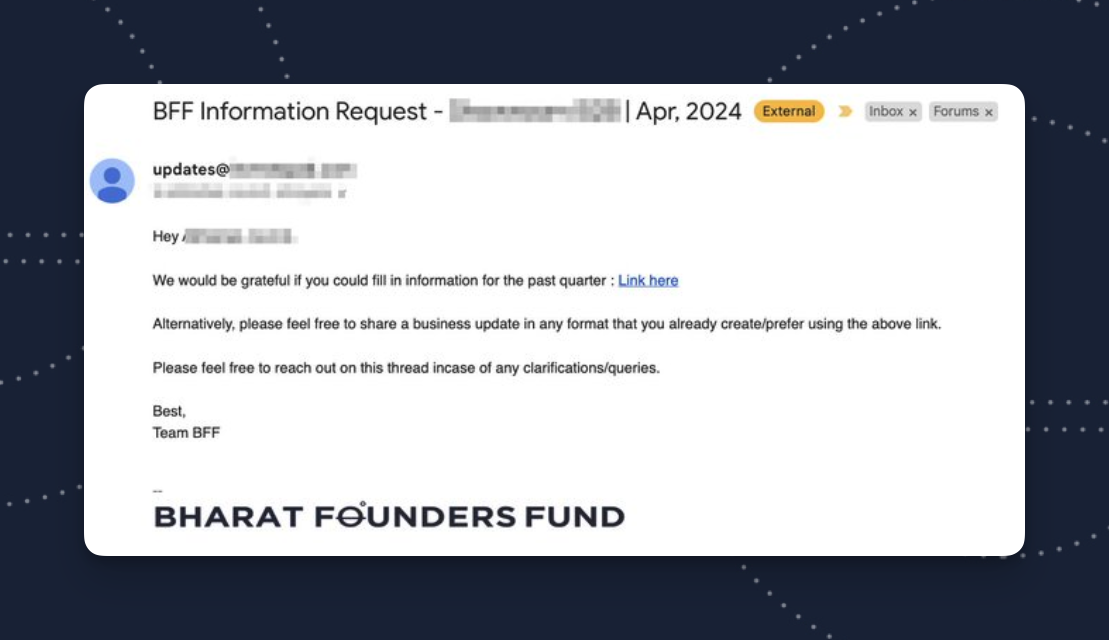

Our emails don't just nag - they engage. Here's what founders see in their inboxes:

But we didn't stop at sending emails. We automated the entire cycle - from request to review. When updates roll in, they're instantly logged and follow-ups cease.

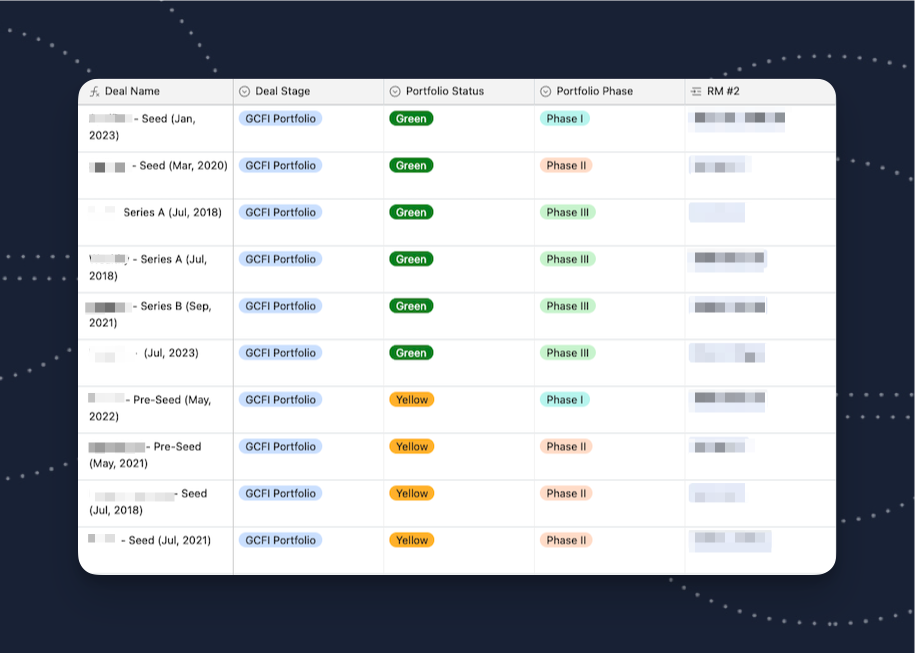

This is when human intervention becomes important in the review process. Post a stipulated timeline in the data collection process every quarter, the Investment team assigns a status to each portfolio company and selects which companies to discuss in the next huddle. Here’s what status indicators mean:

Lagging/Red: Not doing well / if the company hasn’t provided a substantive update in 6+ months

At Risk/Yellow: No signs of early PMF / if the company hasn’t provided a substantive update in 3+ months

On track/Green: Should we bring it into the pipeline again to track closely?

Portfolio Management

Our quarterly portfolio reviews begin with creating a reporting dashboard that allows founders to share updates efficiently and us to slice the data intelligently. But it's not a “set it and forget it”. We schedule periodic deep-dive sessions to discuss challenges, brainstorm solutions, and identify areas where our network and resources can be catalytic.

While we maintain periodic investment review documents for portfolio companies, our dashboards give us a simple overview on outlook of our portfolio:

As companies grow and cross certain thresholds of progress, we change the processes through which we manage our relationship with them. We have 4 phases through which we manage the relationship.

For instance, here is what best practices for Phase 1 looks like:

People Intelligence

Leveraging relationships intelligently is our secret sauce. We've built a curated, searchable database of experts and advisors across domains. Each interaction is meticulously logged, tagged, and mapped, giving us a proprietary edge in deal sourcing, diligence, and portfolio support.

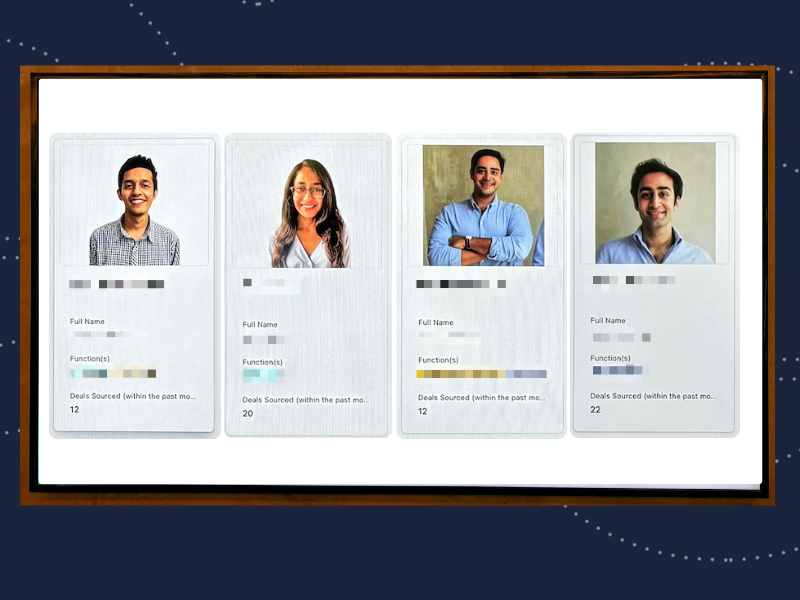

Dashboards in our office track top referrers from our close network:

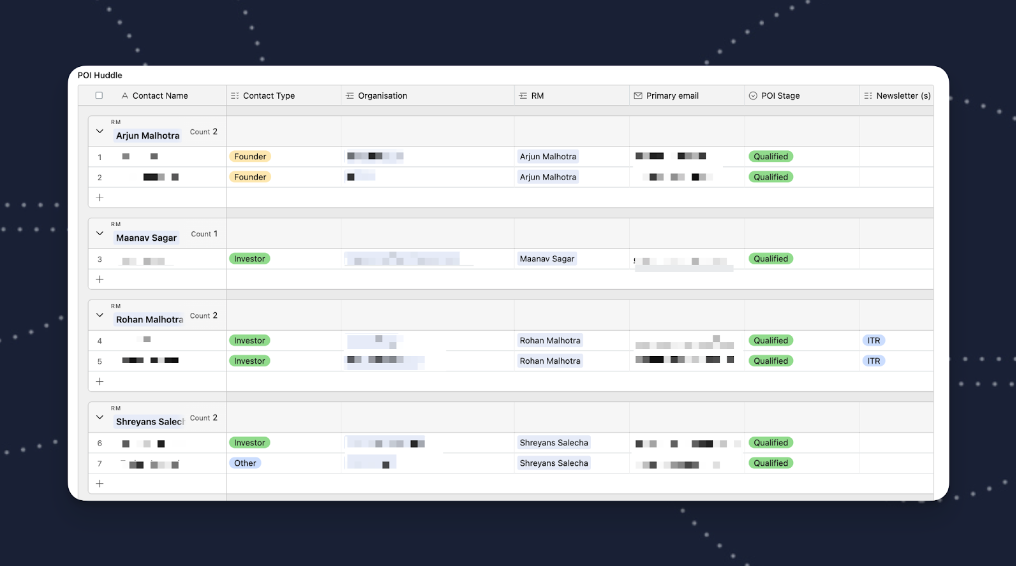

POI Huddles

Our weekly POI (Person of Interest) Huddles are dedicated to capturing and disseminating this knowledge. Team members share profiles of interesting people they've engaged with, highlighting their background, expertise, and potential value-add to our ecosystem. This collective intelligence allows us to tap into the right minds at the right time, whether it's for a specialist deep dive or a critical investor intro.

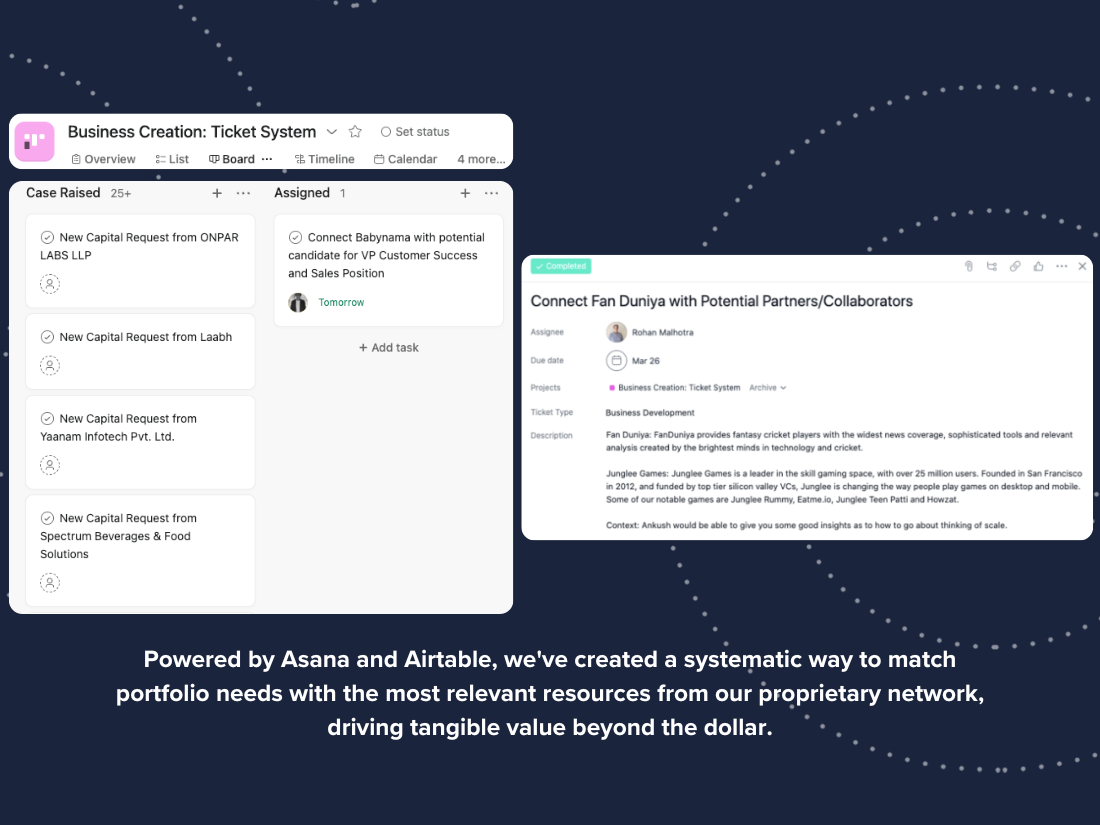

Business creation

We also plug this network intelligence into our "Business Creation" workflow. Startups often need more than just capital - they need access to talent, advisors, and partners to catalyze their growth. Powered by Asana and Airtable, we've created a systematic way to match portfolio needs with the most relevant resources from our proprietary network, driving tangible value beyond the dollar.

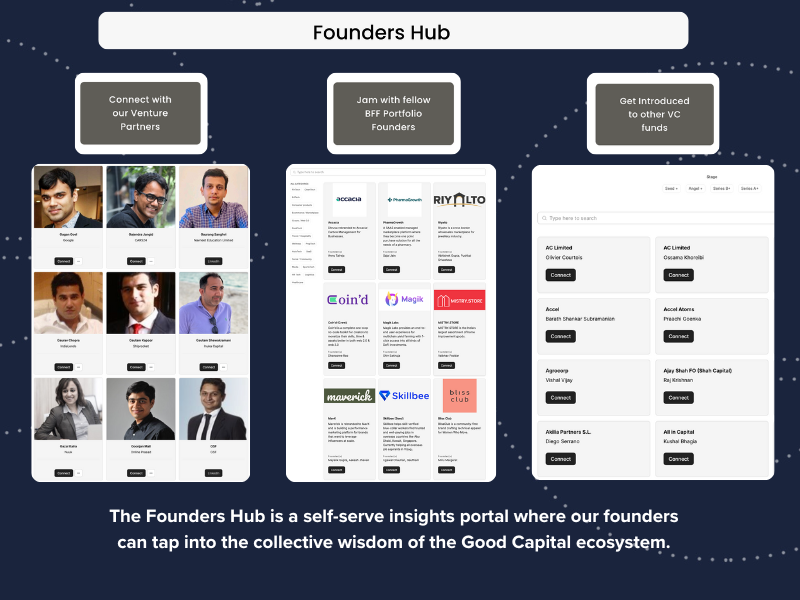

Founders Hub

We've also created a "Founders Hub" - a self-serve insights portal where our founders can tap into the collective wisdom of the Good Capital ecosystem. From playbooks to benchmarks to connections with industry experts, we aim to democratize access to the knowledge and tools needed to scale successfully.

More than just Intelligent Investing

As we've seen, our tech stack isn't just about finding the next unicorn—it's about nurturing them too. Our processes are designed to augment, not replace, the deep domain expertise and pattern recognition our team brings to the table. We believe the magic happens at the intersection of human insight and machine intelligence.

In the next issue, we'll explore how technology amplifies our fundraising efforts, deepening relationships with LPs and expanding our capital horizons.