Small Cities, Massive Real Estate Opportunity

How is Propacity revolutionising property deals in Tier 2 markets?

The Hidden Opportunity in India's Emerging Real Estate Markets

We're always on the lookout for founders who see around corners. When we first met Rahul, Uday, and Imran at Propacity, we were struck by their unique focus in India's real estate market: while most players were fighting for a slice of the metro markets, Propacity saw an untapped goldmine in Tier 2 & 3 cities.

Their thesis? The next wave of real estate growth in India isn't coming from the metros - it's emerging from the heartland. Improved connectivity, infrastructure upgrades, and rising incomes transform tiny towns into vibrant economic hubs. The numbers back this up: India needs 93 million new housing units by 2036, and much of this demand will come from these emerging markets.

But these markets, while full of potential, are often unorganized and hard to access. Developers struggle to sell properties because of limited broker relationships, while real estate investors lack reliable, trustworthy information and access. It's a classic emerging market problem - high potential meets high friction.

This is where Propacity comes in. They're building the digital infrastructure to make exploring, investing, and tracking real estate across Bharat easy and intelligent. It's a bold vision and one that could reshape how real estate transactions happen in India's next growth frontier.

Building the Operating System for Emerging Real Estate Markets

At its core, Propacity is creating an end-to-end platform that connects builders, brokers, and investors. Their goal is to accelerate sales velocity, increase transparency, and deliver a predictable customer experience for every transaction in these underserved markets.

Here's how it works:

For Developers

Propacity offers a powerful CRM to manage all stakeholders - brokers, customers, inventory, and collections - in a single window. This solves the critical problem of sales velocity and transparency in markets where traditional methods fall short.

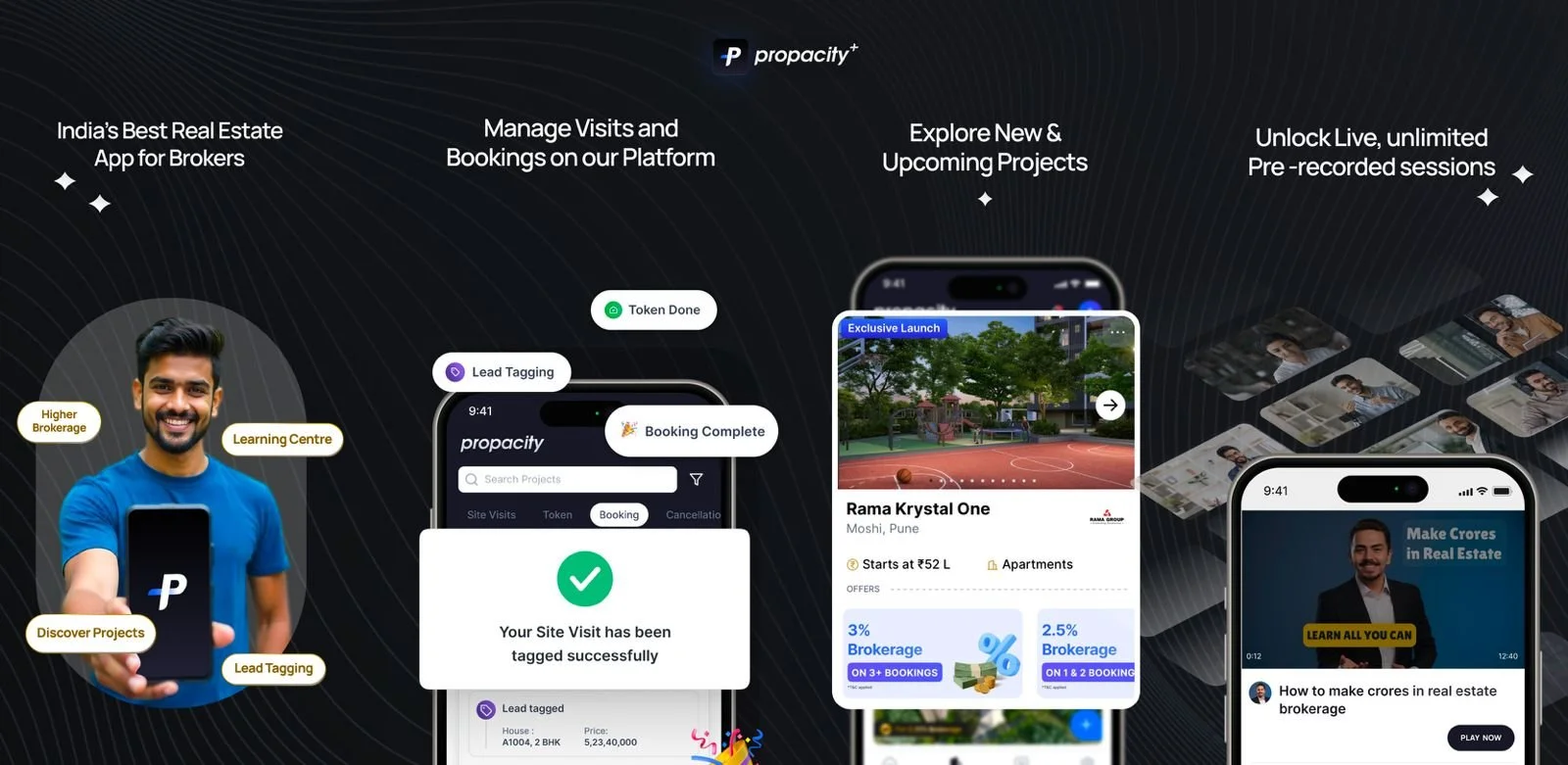

For Brokers

The platform unlocks vetted supply, provides marketing guidance, and offers key market insights. Brokers can track leads end-to-end, cutting down on inefficient offline follow-ups. Most importantly, Propacity opens up new earnings opportunities. A broker in Mumbai can now easily sell properties in Haridwar, leveraging their existing customer base to tap into high-growth markets.

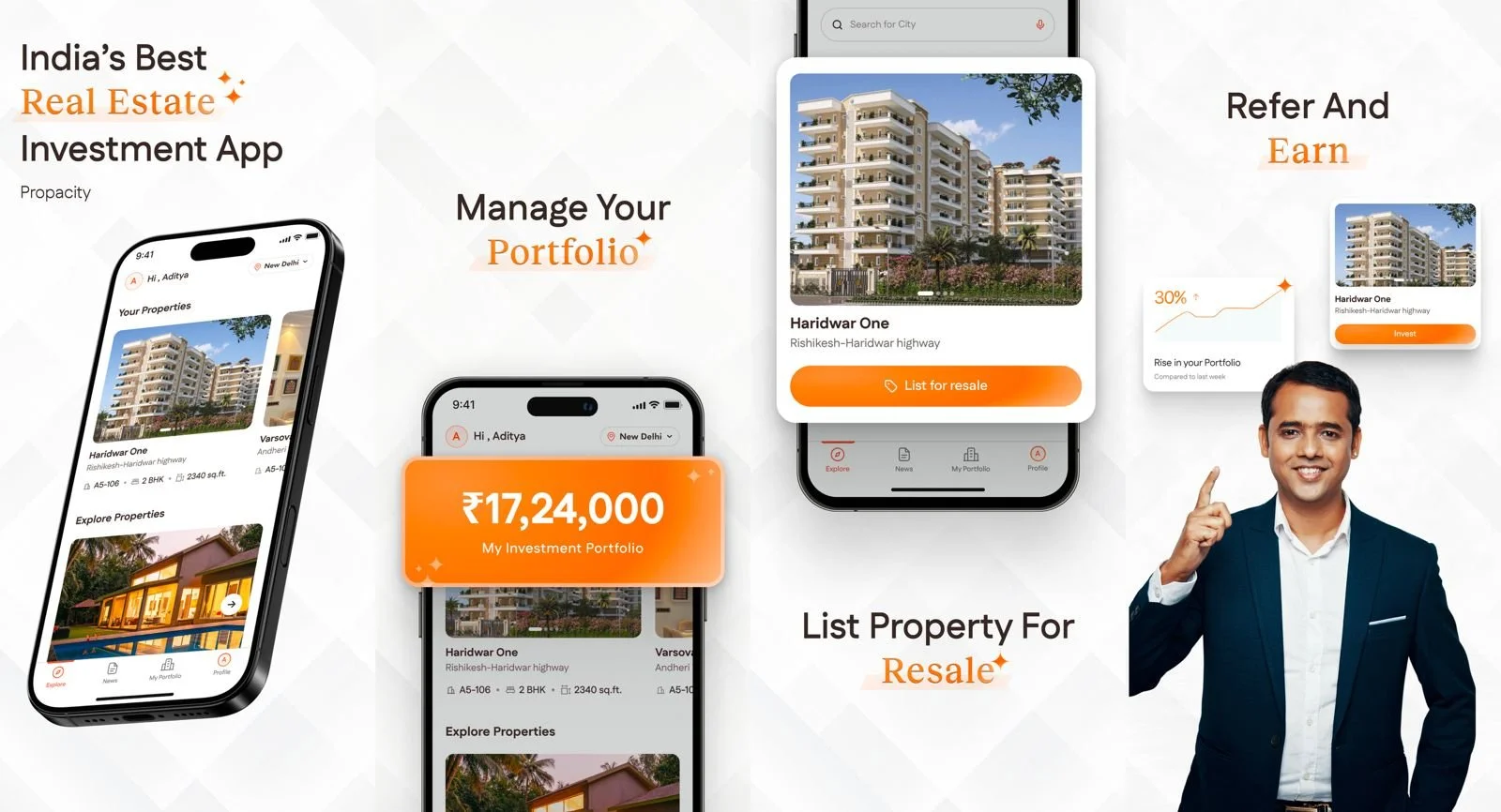

For Real Estate Investors

Propacity solves the twin problems of supply and trust. Investors get easy access to high-quality, vetted properties and reliable brokers. They can digitally track investments, manage payments, and even find liquidity through referral, brokerage, or resale opportunities.

This three-sided marketplace approach is creating powerful network effects. Each new developer brings more inventory, attracting more brokers, who in turn bring more real estate investors - creating a virtuous cycle of growth.

Traction That Speaks Volumes

What's most impressive about Propacity is how quickly they've gone from concept to real-world impact. Their pilot in Dholera, India's first Special Investment Region (SIR), demonstrated the platform's ability to unlock velocity in emerging markets - successfully selling 100 plots in just 60 days through their broker network in Delhi. Building on this momentum, they secured their first exclusive mandate in Pune's emerging Moshi micromarket, partnering with a leading developer to sell 300 apartments. Their broker engagement strategies have already shown remarkable results, increasing monthly walk-ins to over 400, up from the developer's previous average of 250.

The platform's growth has been equally impressive on the broker side. Propacity Plus, their broker empowerment initiative, has already attracted over 2,000 brokers from across 100+ pin codes nationwide. What's particularly noteworthy is how they're not just building a network, but creating a new breed of tech-enabled real estate agents through educational initiatives and market insights. Their technology infrastructure is processing over 2 lakh monthly customer conversations through their CRM, while their content strategy has helped them reach 1 lakh+ monthly organic visitors - building a foundation for sustainable, zero-CAC growth.

Perhaps most telling is the 300 Cr+ supply pipeline they're building across cities like Pune, Noida, Haridwar, and Dholera. This is a testament to the latent demand from developers to tap into Propacity's unique distribution network and technology stack. These early wins demonstrate not just market validation, but also the platform's ability to create tangible value for all stakeholders in India's emerging real estate markets.

A New Chapter in India's Real Estate Story

Propacity is riding multiple macro trends: the shift in economic growth to Tier 2-3 cities, the increasing sophistication of brokers and their adoption of technology, and the hunger for transparent, reliable real estate investments in emerging markets. This transformation is further accelerated by the rapid growth in infrastructure, which is leading to more developable land, the emergence of new micro markets, and an influx of new developers entering the market.

Additionally, rising disposable incomes among Indians are driving growing interest in investing in newly developed towns and cities, as well as in experiential properties in locations like Haridwar, Goa, and similar destinations. Propacity sits at the intersection of all these forces.

Their approach also aligns perfectly with our worldview at Good Capital. We look for companies that empower local intermediaries rather than try to remove them. Propacity isn't trying to eliminate brokers - they're supercharging them with technology, data, and access to new markets.

Their vision of making real estate across Bharat accessible, transparent, and efficient is one we're excited to support. As they say in real estate, it's all about location, location, location - and we believe Propacity is in exactly the right place at the right time.